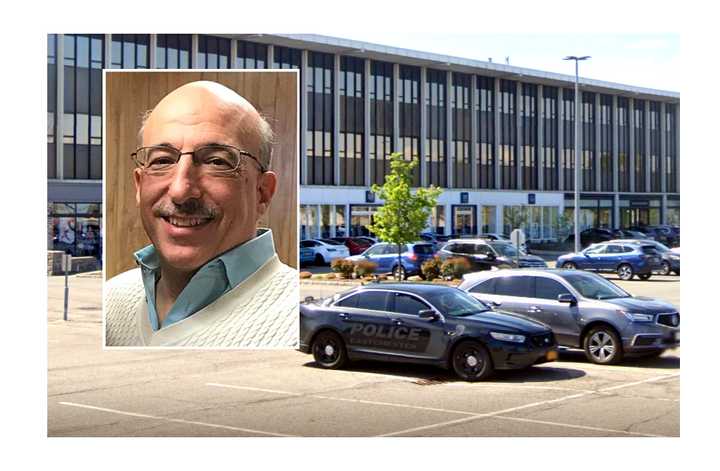

Certified public accountants New Jersey resident Jack Sardis, age 66, of Englewood Cliffs in Bergen County, and his partner, George Sanossian, age 70, of Scarsdale, both admitted to scheming with their clients to reduce tax liabilities through a shell company, leading to over $2 million in unreported cash transactions, the US Attorney's Office for the Southern District of New York announced.

The duo had been partners at a Scarsdale-based accounting firm, Sanossian, Sardis & Co., LLP, which ran out of a small office in a large shopping center at 700 Post Rd. # 30.

According to federal officials, Sardis and Sanossian directed their clients to issue checks payable to a shell company. The partners would then cash the checks and return the cash to the clients, keeping a fee in the process.

Some of the duo's clients, including nine construction companies, used this cash to pay their employees without reporting the wages on their tax forms, thus avoiding taxes and their contributions to Social Security and Medicare.

Officials said that this also allowed their employees to evade federal and state income tax.

Sanossian and Sardis caused checks to be cashed in this manner for clients in a total amount exceeding $2 million. This cost the IRS $652,884 in total, federal officials said.

Sardis had been well-known in his hometown as a volunteer firefighter in Englewood Cliffs, serving for nearly 30 years. During this time, he was one of the first responders who helped rescue survivors at Ground Zero on 9/11.

He also served as an assistant Boy Scout master for decades.

According to an IRS complaint, Sardis offered to do business with a client related to the scheme at a firehouse.

Sanossian and Sardis pleaded guilty to one count of conspiracy to defraud the IRS on Wednesday, May 29, and Wednesday, June 5, respectively. They both face a maximum of five years in prison. They also agreed to pay restitution of $652,883.60 to the IRS and New York State.

Sanossian is scheduled to be sentenced on Tuesday, September 24, while Sardis's sentencing will occur on Thursday, Sept. 26.

Click here to follow Daily Voice Middletown-Wallkill and receive free news updates.